The Key to Accelerated Depreciation in Real Estate

What Is Cost Segregation?

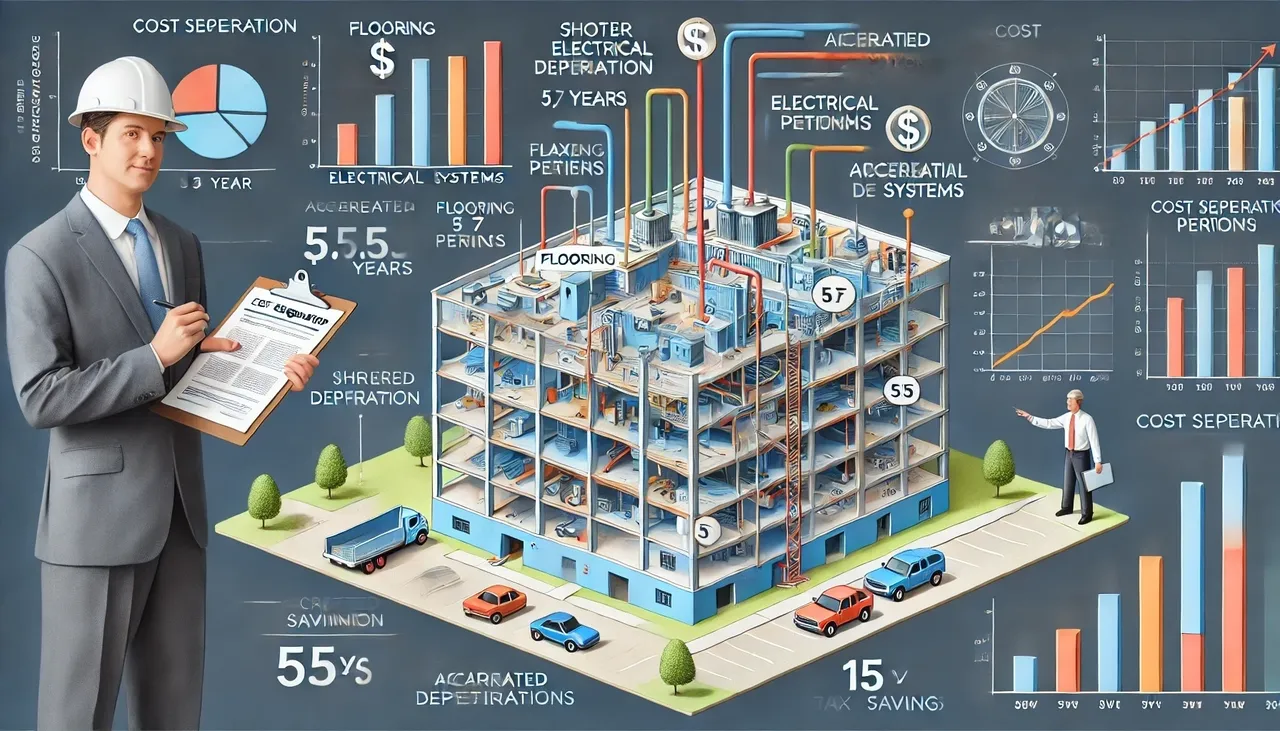

At its core, cost segregation is the process of identifying and reclassifying personal property assets and land improvements within a real estate property to shorter depreciation periods. Rather than depreciating an entire property over the standard 27.5 years for residential or 39 years for commercial properties, cost segregation allows investors to separate specific components and depreciate them over much shorter periods—5, 7, or 15 years.

How Does It Work?

A cost segregation study, often conducted by specialized engineers or tax professionals, involves a detailed analysis of a property’s components. This study breaks down the property into various parts, such as electrical systems, plumbing, flooring, and even landscaping, which can qualify for accelerated depreciation.

For example, while the structure of a building may be depreciated over 27.5 or 39 years, assets such as carpet, appliances, lighting fixtures, and parking lots can be depreciated over 5, 7, or 15 years. By reclassifying these assets, the property owner can deduct a larger portion of the property’s value in the early years of ownership, resulting in significant tax savings upfront.

The Benefits of Accelerated Depreciation

The primary benefit of cost segregation is the ability to accelerate depreciation and increase tax deductions in the earlier years of property ownership. This creates a significant cash flow advantage, as real estate owners can reduce their taxable income by taking larger depreciation deductions sooner.

By accelerating depreciation, property owners can:

- Increase Cash Flow: More significant deductions mean lower taxable income, which translates into more money to reinvest or use for other business needs.

- Defer Taxes: By claiming accelerated depreciation, investors can defer taxes on their income, keeping more capital in hand during the early years of property ownership.

- Maximize Deductions: Cost segregation allows real estate investors to capture deductions that might otherwise be spread out over decades.

A Real-World Example

Imagine an investor purchases a commercial property for $1 million. Without cost segregation, the building would be depreciated over 39 years, resulting in an annual depreciation deduction of about $25,641. However, after a cost segregation study, the investor might find that $200,000 worth of assets within the property—such as flooring, fixtures, and HVAC systems—can be reclassified and depreciated over 5, 7, or 15 years. This could result in a much larger deduction in the first few years, potentially saving the investor tens of thousands of dollars in taxes annually.

Who Can Benefit from Cost Segregation?

Cost segregation is particularly advantageous for real estate investors who hold properties for a long term, plan to make significant improvements, or are looking for ways to maximize tax savings quickly. However, even small investors can benefit, especially if they own rental properties with substantial interior or exterior improvements.

When Is Cost Segregation Most Effective?

Cost segregation is most effective for newly purchased or constructed properties but can also be applied retroactively. If an investor hasn’t performed a cost segregation study on a property, they may be able to “catch up” on missed depreciation by conducting a study and filing a change in accounting method, allowing them to claim unclaimed depreciation in the current tax year.

Conclusion

Cost segregation is a strategic tool that can accelerate depreciation, resulting in increased tax savings and improved cash flow for real estate investors. By breaking down a property’s components and reclassifying them for shorter depreciation periods, investors can unlock significant financial benefits. To fully maximize these savings, it’s essential to consult a qualified tax advisor or professional experienced in cost segregation studies. With the right guidance, real estate owners can leverage this strategy to enhance profitability and long-term success.

Sypnopsis

In this quick explainer, we break down the concept of cost segregation and how it benefits real estate investors. Instead of depreciating an entire property over decades, cost segregation allows owners to reclassify specific components—like electrical systems, flooring, and parking lots—for faster depreciation (5, 7, or 15 years). This strategy results in larger tax deductions upfront, boosting cash flow, and deferring taxes. Whether you own residential or commercial properties, cost segregation can maximize your tax savings and help you reinvest faster.